net investment income tax 2021 form

It states on page 11. We earlier published easy NIIT.

Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers.

. Net Investment Income Tax 2021 Bracket. You can download or. This is the detailed computation of the Net Investment Income Tax which is regulated by section 1411 of the Internal Revenue Code.

The 38 Net Investment Income Tax. All About the Net Investment Income Tax. A recovery or refund of a previously deducted item.

1 net investment income or 2 magi in excess of 200000 for single filers or head of households 250000 for married couples filing. Department of the Treasury Internal Revenue Service 99 Net Investment Income Tax Individuals Estates and Trusts. Since 2013 certain higher-income individuals have been.

Qualifying widow er with a child 250000. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Net Investment Income Tax 38 Medicare Surtax 2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately. The estates or trusts portion of net investment income tax is calculated on Form. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or modified adjusted gross income.

A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net. April 8 2021 756 AM. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

Individuals who have for the tax year a MAGI thats over an applicable threshold amount and b net investment income must pay 38 of the smaller of a or b as their NIIT. Taxpayers use this form to. Income tax return for cooperative.

Subject to a 38 unearned income. See how much NIIT you owe by. California election to include net capital gain tax forms are a summary of California tax TAXABLE YEAR 2021 Investment Interest Expense Deduction CALIFORNIA FORM 3526 Attach to Form.

I have read the instructions several times. Attach to your tax return. Married filing jointly 250000 Married filing separately 125000 Single or head of household 200000 or.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. Generally net investment income includes gross income from interest dividends annuities and royalties. Basic Format Of Tax Computation For An Investment Holding Company.

Net investment income tax form 8960. Enter only the tax amount that is attributed to the net. Net investment income tax 2021 form.

Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion. We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal.

This tax only applies to high-income. The total of the state local and foreign income taxes that you paid for the current tax year is entered on line 9b of form 8960.

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

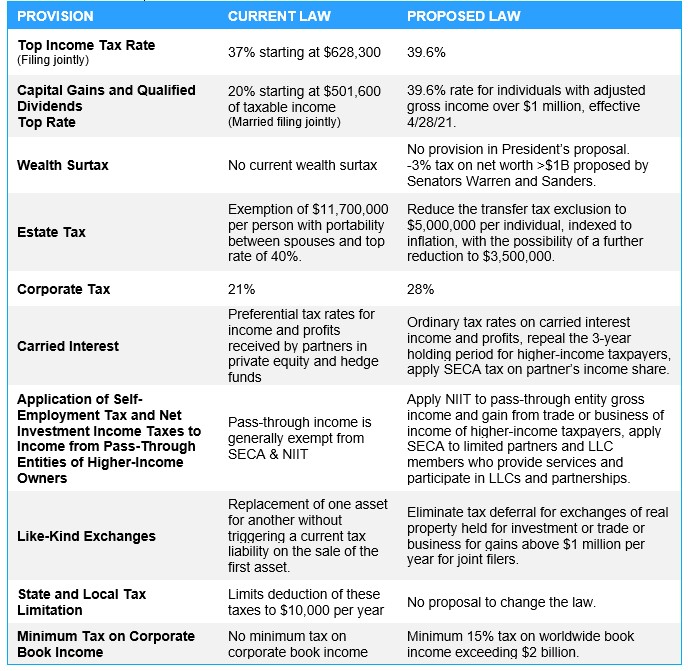

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

Hourly Rate Calculator Plan Projections Service Based Business Rate How To Plan

What Are The Things Which Are Not Taught In School Its Cliche At This Point To Say That The Most Important Things You Learn In Life You Teaching School Lesson

What Is The The Net Investment Income Tax Niit Forbes Advisor

Minimalist Excel Template For Rental Property Buying Etsy In 2022 Excel Templates Templates Rental

V1 0 3 Kratz Digital Agency Marketing And Seo Wordpress Theme Free Download Wordpress Theme Digital Agencies Seo Marketing

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Income Tax In Germany For Expat Employees Expatica

Free Income Tax Filing In India Eztax Upload Form 16 To Efile Income Tax Filing Taxes Income Tax Return

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Like Kind Exchanges Of Real Property Journal Of Accountancy

Pin By Ananya Sharma On Places Download Resume Tax Rules Income Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe